The approval of the 8th Pay Commission has brought a wave of optimism among central government employees in India. One of the most talked-about aspects of this pay revision is the fitment factor, which plays a crucial role in determining the salary increments, pension benefits, and overall financial well-being of government employees and pensioners. The 8th Pay Commission is expected to be implemented on 1st January 2026, and the fitment factor will serve as a key multiplier in adjusting both basic pay and pensions. Here’s everything you need to know about the 8th Pay Commission Fitment Factor and its impact on both employees and pensioners.

What is the 8th Pay Commission fitment factor?

The fitment factor is a multiplier used to adjust the basic pay of government employees as well as their pension. It ensures that the salaries and pensions are in line with the current economic conditions and inflation levels. The fitment factor affects the final salary structure, including the basic pay, allowances, and pension benefits.

How Does the Fitment Factor Work?

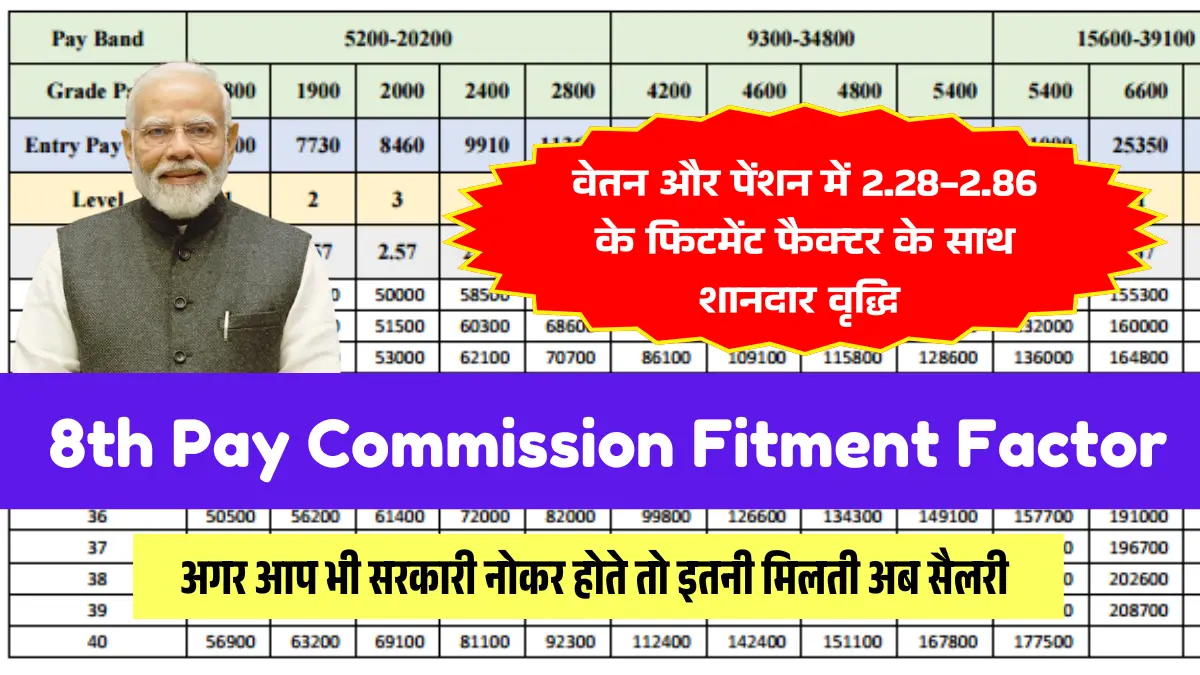

Under the 7th Pay Commission, the fitment factor was set at 2.57, leading to substantial increases in pay and pensions. For example:

- The minimum basic pay increased from Rs 7,000 to Rs 18,000 per month.

- Pensions were revised upward, with many employees witnessing hikes in their pension amounts, from Rs 3,500 to Rs 9,000.

Now, with the 8th Pay Commission, the fitment factor is expected to range between 2.28 and 2.86. Depending on the exact multiplier adopted, salaries and pensions will rise significantly.

Projected Fitment Factor for the 8th Pay Commission:

For the 8th Pay Commission, the projected fitment factor is expected to range from 2.28 to 2.86. This range suggests that employees could see substantial hikes in their basic pay:

- The minimum basic pay could rise from Rs 18,000 to between Rs 41,000 and Rs 51,480 per month.

How Will the Fitment Factor Affect Pensioners?

The 8th Pay Commission fitment factor will not only impact salaries but also the pensions of government retirees. The pensioners will benefit from the same fitment factor that is applied to the employees’ basic pay, ensuring that their pensions are revised accordingly. The projections for pensioners include:

- A substantial increase in pension amounts based on the new fitment factor.

- The minimum pension could see an upward revision from the current amounts.

- The maximum pension will also rise depending on the adopted fitment factor.

8th Pay Commission Fitment Factor Calculator

The fitment factor calculator for the 8th Pay Commission will be used to calculate the revised salary and pension of government employees and pensioners. This tool helps determine how much the basic pay and pension will increase based on the chosen fitment factor.

Here’s how it works:

- Basic Pay Calculation for Employees:

New Basic Pay = Old Basic Pay × Fitment Factor

For example:

If the old basic pay is Rs 18,000 and the fitment factor is 2.57, then:

New Basic Pay = 18,000 × 2.57 = Rs 46,260. - Pension Calculation for Pensioners:

New Pension = Old Pension × Fitment Factor

If the old pension is Rs 9,000 and the fitment factor is 2.57, then:

New Pension = 9,000 × 2.57 = Rs 23,130.

This fitment factor will ensure that both government employees and pensioners are adequately compensated in line with the increasing costs of living.

Benefits of the 8th Pay Commission Fitment Factor:

- Increased Basic Pay: The minimum basic pay for central government employees will rise significantly, providing financial relief to workers at all levels.

- Higher Pension Amounts: Pensioners will also receive increased benefits based on the same fitment factor, ensuring a better standard of living for retired government employees.

- Improved Financial Stability: The new fitment factor will help employees and pensioners adjust to the current economic conditions and rising inflation.

- Boost in Morale and Productivity: With better financial compensation, employees will be motivated to work more efficiently, contributing to improved productivity within the public sector.

Conclusion:

The 8th Pay Commission and its fitment factor are set to bring about significant changes to the salary and pension structures of central government employees and pensioners. With an expected rise in the minimum basic pay to Rs 41,000 to Rs 51,480, the government is ensuring that its employees are well-compensated. The fitment factor will play a critical role in determining the exact pay and pension increases, and it will provide financial stability to employees and retirees alike. As the implementation of the 8th Pay Commission approaches in January 2026, both employees and pensioners can look forward to a positive financial future.